Life Insurance in and around New York

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

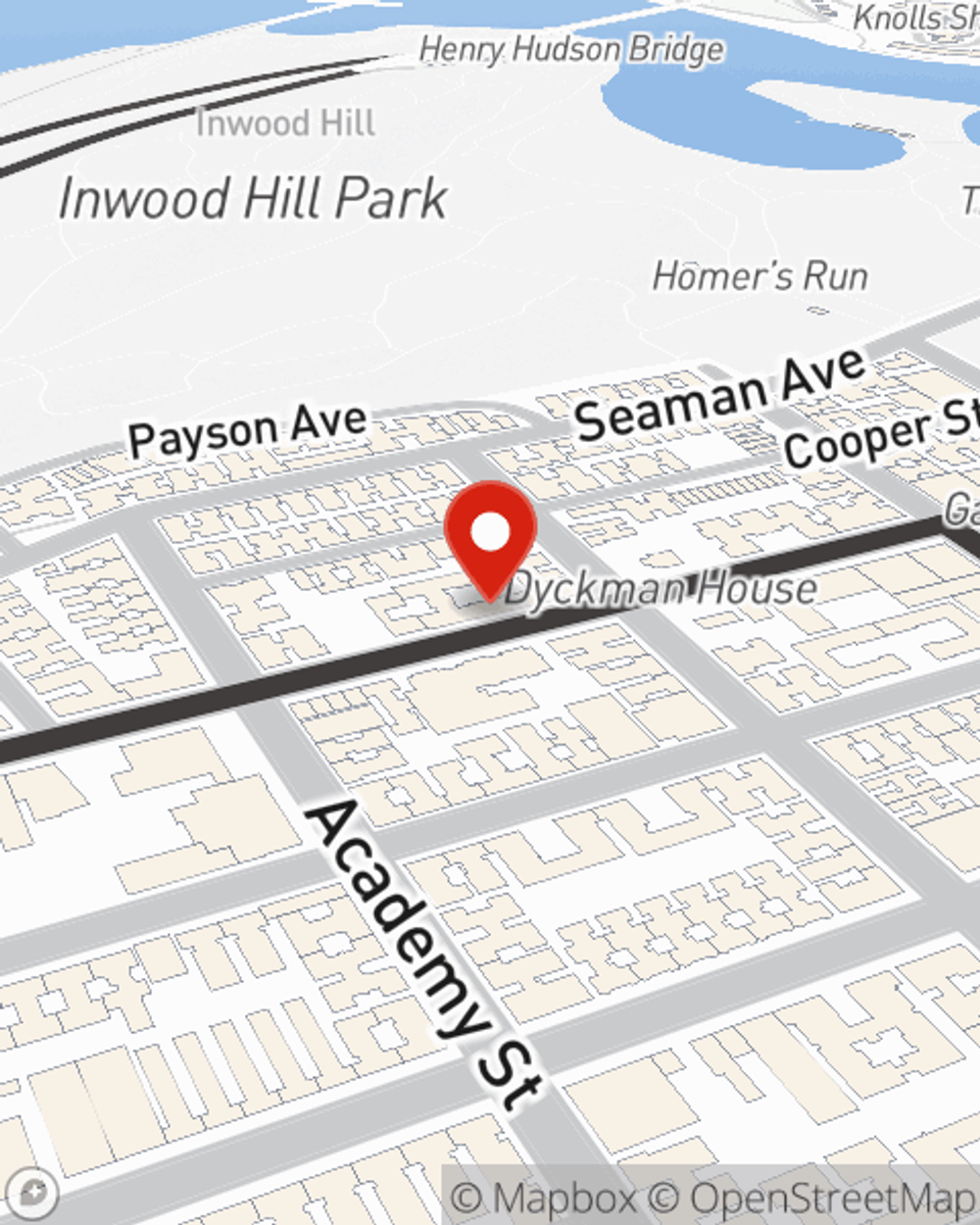

- NEW YORK

- BRONX

- QUEENS

- BROOKLYN

- YONKERS

- NEW JERSEY

- PENNSYLVANIA

- CONNECTICUT

- WASHINGTON HEIGHTS

- MOTT HEAVEN BRONX

- WHITE PLAINS NY

- FORT LEE NJ

- NEWARK NJ

- STAMFORD CT

- HOBOKEN NJ

- ELIZABETH NJ

- HARLEM NY

- WEST NEW YORK NJ

- NEW ROCHELLE, NY

- PORT CHESTER NY

- MT VERNON NY

- PELHAM BAY BRONX

- LONG IS CITY, NY

- LONG ISLAND

It's Never Too Soon For Life Insurance

Can you guess the price of a typical funeral? Most people aren't aware that the average cost of a funeral in the U.S. is $8,500. That’s a heavy burden to carry when they are grieving a loss. If your loved ones cannot pay for your funeral, they may fall on hard times in the wake of your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it pays for college, maintains a current standard of living or pays off debts, the life insurance you choose can be there when it’s needed most by your loved ones.

State Farm can help insure you and your loved ones

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep those you love safe with a policy that’s adjusted to accommodate your specific needs. Thank goodness that you won’t have to figure that out by yourself. With empathy and excellent customer service, State Farm Agent Jari Santiago walks you through every step to generate a plan that secures your loved ones and everything you’ve planned for them.

Simply call or email State Farm agent Jari Santiago's office today to explore how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Jari at (646) 478-8484 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Jari Santiago

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.